Tata Asset Management Launches Tata Income Plus Arbitrage Active FoF, Targeting potential Stability and Tax Efficiency in Volatile Markets

Chennai | May 05, 2025: Tata Asset Management has announced the launch of Tata Income Plus Arbitrage Active Fund of Fund, an innovative fund of fund scheme aiming to blend low-volatility strategy of arbitrage funds with steady accrual potential of high-quality corporate bonds. The New Fund Offer (NFO) opens on May 5, 2025 and closes on May 19, 2025.

This open-ended fund of fund investing in domestic mutual fund schemes offers a versatile solution to investors through a balanced mix of interest earned on corporate bonds and equity arbitrage returns.

The Tata Income Plus Arbitrage Active FoF is designed for investors with a two-year horizon, seeking potentially stable, accrual-oriented and tax-efficient returns. The fund allocates maximum of 65% to Tata Corporate Bond Fund and minimum of 35% to Tata Arbitrage Fund, combining the stability of debt with tax efficient returns when a horizon of 2 years is considered.

The Tata Arbitrage Fund, with its 100% hedged equity portfolio, aims for short-term stable gains, while the Tata Corporate Bond fund focusses on accrual returns with selective duration management. This blend wrapped under a ‘Fund of Fund’ structure, offers a balanced approach with better tax efficiency than standalone arbitrage or corporate bond funds when held for over two years.

"In the current environment where debt yields are attractive and volatility in equity market persists, a hybrid strategy like this can potentially offer superior post-tax returns compared to traditional debt funds," said Sailesh Jain, Fund Manager, Tata Asset Management. "The fund’s active allocation and smart liquidity management aim at optimizing returns."

Arbitrage and hybrid strategies have gained traction in recent years as investors look for alternatives that combine the relative safety of debt with the tax efficiency and flexibility of equity-linked products.

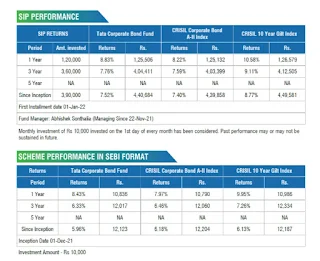

The Tata Corporate Bond Fund – Regular Plan has given annualized return of 8.43% over 1-year horizon, compared to 7.97% return by Crisil Corporate Bond A-II index in the same period. Since its inception in 2021, the fund has given return of 5.96% (Source: Presentation). Meanwhile, the Tata Arbitrage Fund – Direct Plan ranks third among arbitrage funds for both 1-year and 5-year SIP returns, according to Value Research. It has delivered an 8.05% return over a 1-year SIP and 7.06% return over a 5-year SIP.

Key features of the Tata Income Plus Arbitrage Active FoF include a minimum investment amount of Rs 5,000, equity taxation benefits after two years, and a modest exit load of 0.25% if redeemed within 30 days.

Tata Asset Management continues to reinforce its commitment to offering investors well-researched, innovative solutions that align with the changing market dynamics and long-term wealth creation goals.